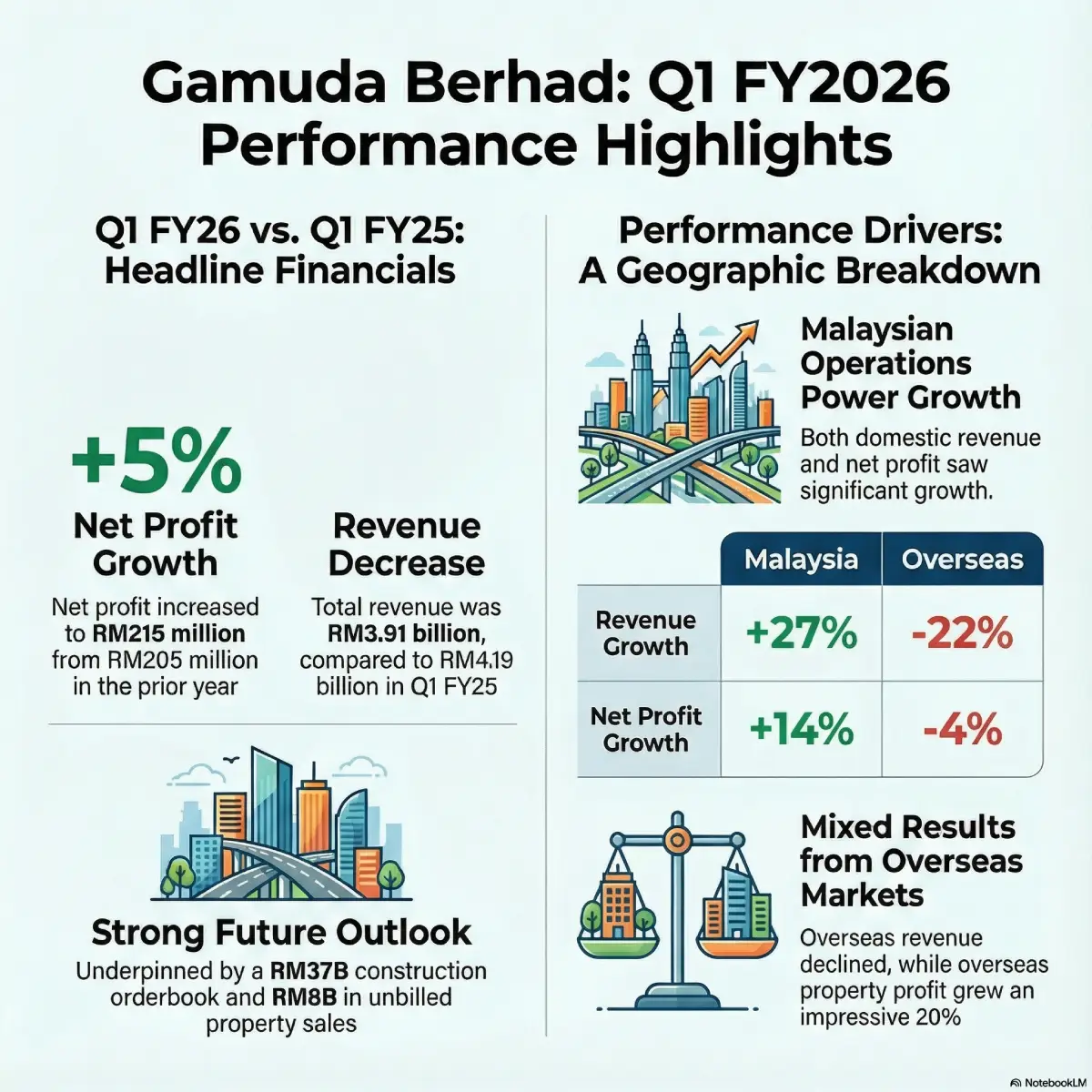

Gamuda Berhad (5398) Q1 FY2026 Review: A Construction Giant in Expansion Mode

Gamuda Berhad’s Q1 FY2026 results demonstrate resilience: while headline revenue dipped 7% due to prior-year one-off items, Net Profit rose 5% to RM215.1 million. This growth was driven by a powerful 53% surge in domestic construction and improved operational efficiency.