Flying Through Turbulence: A Deep Dive into AirAsia X’s Q1-Q3 2025 Performance

Date: December 14, 2025

Company: AirAsia X Berhad (AAX)

Ticker: 5238 (Bursa Malaysia)

Period Reviewed: 9 Months 2025 (Jan 1 – Sep 30, 2025)

1. Introduction: The Big Picture

For investors watching the aviation space, AirAsia X Berhad (AAX) has always been a high-beta play—offering significant potential rewards during upcycles but carrying distinct operational risks. As a medium-to-long-haul low-cost carrier, AAX operates in a niche that requires balancing aggressive pricing with the heavy costs of wide-body aircraft.

Why This Review Matters: Whether you are day-trading price swings or holding for long-term recovery, financial statements are your reality check. The narrative for the first nine months of 2025 (9M 2025) is a classic case of “Top-Line Stability vs. Bottom-Line Pressure.” The airline is flying more passengers and generating stable revenue, but the cost of keeping those planes in the sky has skyrocketed, eating into profits.

This review breaks down the numbers to help you decide if AAX belongs in your portfolio today.

2. Revenue Analysis: Slow Growth, Better Quality?

For Beginners: Revenue is the “Top Line”—the total money the company brought in before paying any bills.

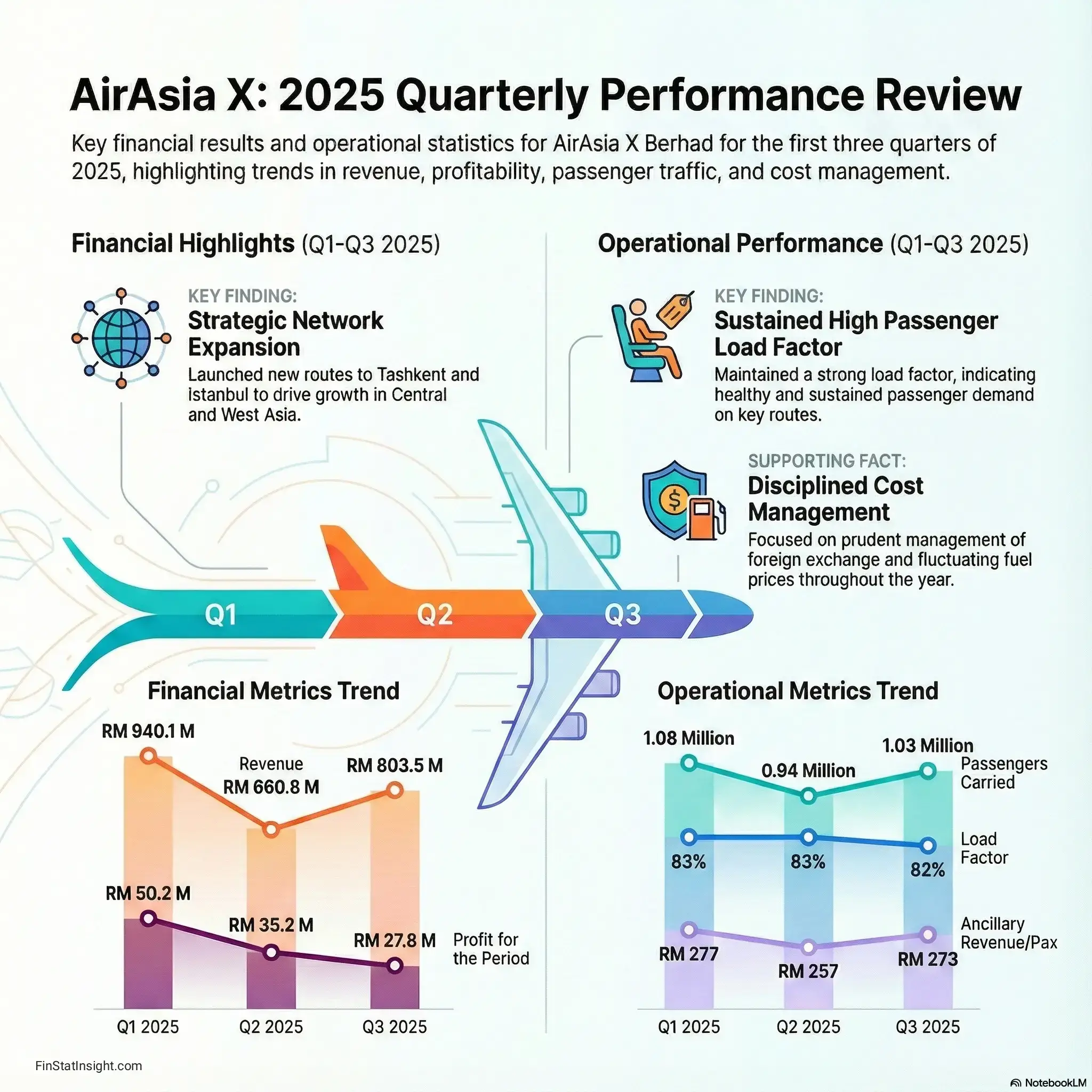

- The Number: RM 2.40 Billion (up slightly by 1.3% from RM 2.37 Billion in 2024).

- Simple Translation: The company is selling about the same amount of tickets and services as last year. There is no explosive growth here, but the business is stable.

For Advanced Investors & Traders: The slight 1.3% headline growth masks underlying shifts in quality and seasonality.

- Ancillary Revenue is King: While ticket sales were flat-to-down (partly due to lower average fares), Ancillary Revenue (baggage, meals, seat selection) surged 12.8% to RM 819.1 million. This is high-margin revenue that flows more efficiently to the bottom line.

- Seasonality Check (Trader Alert):

- Q1 (Peak): RM 940m

- Q2 (Low): RM 661m (The “Dip”)

- Q3 (Recovery): RM 803m

- Insight: The Q2 to Q3 bounce (+22%) signals that demand is resilient. Traders should note this seasonal pattern—Q2 is historically a buy zone for a Q3/Q4 recovery trade.

3. Profit Margins & Cost Analysis: The Profit Squeeze

The Core Problem: While revenue stayed flat, profit collapsed.

- Net Profit: RM 113.2 million (Down 45.2% from RM 206.6 million in 2024).

Why did profit drop if gas prices went down? This is the most critical section for fundamental investors.

- Fuel (The Good News): Fuel costs dropped 12% to RM 1.0 billion. The average fuel price fell from USD 101/bbl (2024) to USD 92/bbl (Q3 2025). This saved the company RM 136.8 million.

- Maintenance (The Bad News): Maintenance & Overhaul costs exploded, rising 25.5% to RM 505.2 million.

- User Charges: Airport/User charges jumped 21.7%.

The “Efficiency” Verdict:

- CASK (Cost per Available Seat Kilometer): The total cost to fly one seat one kilometer decreased slightly due to cheaper fuel.

- CASK ex-Fuel: This is the real measure of management efficiency. It increased consistently across all quarters (7.26 sen in Q1 -> 6.72 sen in Q3).

- Implication: The airline is structurally more expensive to run right now because older aircraft require heavier maintenance as they return to full service. This is a margin killer until the fleet renewal stabilizes.

4. Dividend Review: The Wait Continues

Current Status: No Dividend Declared.

For Dividend Hunters: If you are looking for immediate passive income, AAX is currently not your play.

- Why? The company is in a “Capital Intensive” phase. It generated RM 169.9 million in operating cash but spent RM 238.7 million paying down lease liabilities (debt for planes).

- Future Outlook: Dividends are unlikely to resume until the “Net Current Liability” position is fixed and the acquisition of Capital A’s aviation assets is digested. This is a growth/restructuring stock, not a yield stock.

5. Balance Sheet & Financial Health: Safe, but Tight

Solvency (Can they survive long-term?): * Yes, and improving. Shareholders’ Equity (Net Worth) grew by 34.2% to RM 441.3 million. This is a strong signal that the company is rebuilding value after the pandemic crisis.

Liquidity (Can they pay bills today?): * Net Current Liability: The company owes RM 487.1 million more in the short term than it has in current assets. * Context: This sounds bad, but it is standard for airlines (who collect cash upfront for flights taken later). Importantly, this number improved from RM 525 million last year.

- Cash Position: Cash holdings dropped to RM 81.0 million (from RM 174.8 million). The company is burning cash reserves to pay down lease debts. This leaves little room for error if a new crisis hits.

6. Cash Flow Analysis: Where is the Money Going?

Following the cash tells the real story:

- Operating Cash Flow (+RM 169.9m): The core business is profitable and generating cash. This is the most important “green flag.”

- Investing Cash Flow (-RM 22.0m): Very low capital expenditure. They aren’t buying new planes with cash; they are likely leasing them.

- Financing Cash Flow (-RM 238.7m): This is the heavy lifter. Huge outflows to pay aircraft lessors.

Implication: AAX is currently working for its landlords. The cash it makes from flying is going almost entirely to service aircraft leases. Investors need to see Revenue grow fast enough to outpace these lease payments to start building cash reserves again.

7. Investment Implications

🛍️ Retail & Beginner Investors

- Verdict: Hold / Watch.

- The stock is safer than it was a year ago (Equity is up), but the drop in profit (-45%) might scare the market. Don’t panic sell on headline news, but understand that the “easy recovery gains” might be over.

⚡ Traders & Short-Term Players

- Verdict: Trade the Seasonality.

- Q4 is historically strong. With Q3 showing a recovery in Load Factors (82%) and fares, Q4 results (likely due in Feb 2026) could beat expectations. Watch for a breakout if oil prices drop further.

- Risk: The Thailand segment is a disaster (RM 119m loss). Any bad news from Bangkok could dump the stock.

🏛️ Long-Term Fundamental Investors

- Verdict: Accumulate on Weakness (Cautiously).

- The “Capital A” acquisition (expected completion Dec 2025) will transform the company into a much larger aviation group. You are buying the future entity, not just today’s AAX. The current maintenance cost spike is likely temporary (catch-up repairs). If you believe in the merger story, current prices might be a discount.

💰 Dividend Hunters

- Verdict: Avoid.

- Look at banking or REIT stocks. AAX needs every Ringgit for debt repayment and fleet expansion.

Disclaimer: This analysis is for educational purposes based on the provided financial data for Q1-Q3 2025. It does not constitute financial advice. Please consult a licensed financial planner before making investment decisions.

8. Key Takeaways

- Profit Squeeze: Revenue is flat, but Net Profit fell 45% due to soaring maintenance costs.

- Tale of Two Hubs: Malaysia is profitable (RM 128m profit), but Thailand is bleeding heavily (RM 120m loss). Fixing Thailand is priority #1.

- Fuel Hedging: Lower fuel prices are saving the company, but not enough to offset other rising costs.

- Ancillary Growth: The company is getting better at upselling (baggage/seats), which is a healthy long-term trend.

- The Catalyst: All eyes are on the acquisition of Capital A’s aviation business. This corporate exercise will redefine the stock’s value in 2026.

9. Company Information

- About the Company: AirAsia X Berhad is a leading medium-to-long-haul low-cost airline operating primarily in the Asia-Pacific region. Originally established as Fly Asian Express, it rebranded in 2007 to focus on the high-growth low-cost long-haul segment.

- Location: RedQ, Jalan Pekeliling 5, Lapangan Terbang Antarabangsa Kuala Lumpur (KLIA), 64000 Sepang, Selangor, Malaysia.

- Listed on Bursa Malaysia: July 10, 2013.