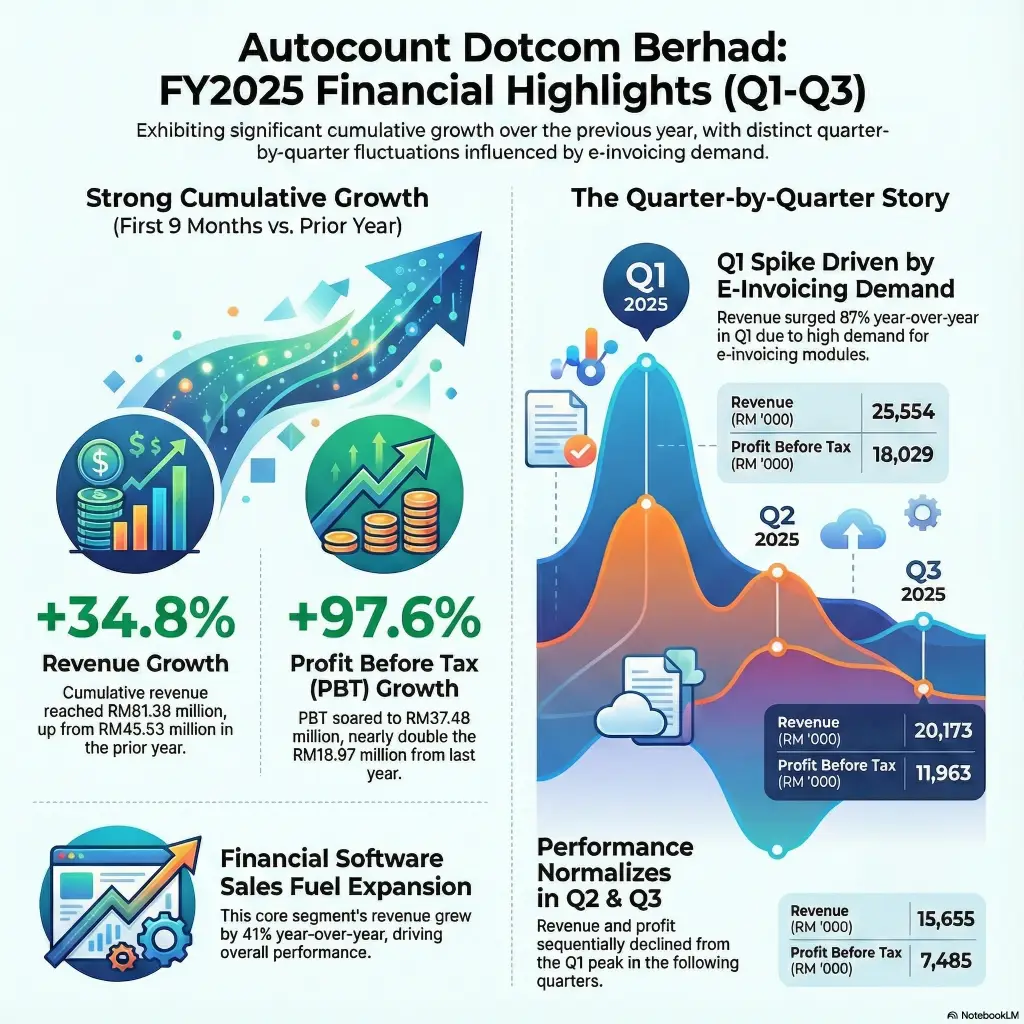

Autocount Dotcom Berhad FY2025 Summary

Autocount Dotcom Berhad reported strong results in the first nine months of FY2025.

- Revenue: RM61,382k ▲ 34.81% YoY

- PBT: RM37,477k ▲ 97.55% YoY

- PAT: RM27,412k ▲ 90.93% YoY

The growth was powered by the financial management software distribution segment, demonstrating strong operating leverage and efficient cost management.

Quarter-by-Quarter Performance

| Quarter | Revenue (RM’000) | YoY Change | PBT (RM’000) | YoY Change | QoQ Revenue | QoQ PBT |

|---|---|---|---|---|---|---|

| Q1 FY2025 | 25,554 | ▲ 86.96% | 18,029 | ▲ 235.42% | ▲ 69.59% | ▲ 179.56% |

| Q2 FY2025 | 20,173 | ▲ 49.30% | 11,963 | ▲ 100.08% | ▼ 21.06% | ▼ 33.65% |

| Q3 FY2025 | 15,655 | ▼ 14.66% | 7,485 | ▼ 1.72% | ▼ 22.40% | ▼ 37.43% |

Green (▲) indicates growth, Red (▼) indicates decline.

Revenue by Business Segment

| Segment | Revenue (RM’000) | % of Total |

|---|---|---|

| Distribution of financial management software | 57,072 | 92.98% |

| Technical support & maintenance | 2,766 | 4.51% |

| Others | 1,544 | 2.52% |

| Total | 61,382 | 100.00% |

Revenue by Geography

| Region | Revenue (RM’000) | % of Total |

|---|---|---|

| Malaysia | 56,012 | 91.25% |

| Singapore | 4,715 | 7.69% |

| Others | 655 | 1.06% |

| Total | 61,382 | 100.00% |

Financial Position & Cash Flow

| Item | 30 Sep 2025 | 31 Dec 2024 | Change |

|---|---|---|---|

| Total Assets | 80,614 | 75,915 | ▲ 6.19% |

| Total Liabilities | 23,920 | 13,580 | ▲ 76.14% |

| Total Equity | 56,694 | 62,335 | ▼ 9.05% |

| Net Assets per Share | 0.10 | 0.11 | ▼ 9.09% |

Cash Flow Highlights:

- Net cash from operating activities: RM37,701,000

- Net cash used in investing activities: RM(5,157,000)

- Net cash used in financing activities: RM(33,086,000) (mainly dividends)

Strategic Initiatives & Outlook

The Group is positioned to capitalize on:

- Digitalization trends: high demand for automated financial management solutions.

- Governmental support: RM50 million digitalization grant for e-POS, CRM, e-commerce, and remote work.

- Strategic expansion: regional growth funded by IPO proceeds.

- Product innovation: AutoCount e-Invoicing, OneSales PalmPOS, and cloud accounting programs with IAB LCCI.

Despite Q2–Q3 fluctuations, strong cumulative 9M performance and clear strategic initiatives position Autocount Dotcom Berhad for sustained growth in the digital finance sector.

About Autocount Dotcom Berhad

Autocount Dotcom Berhad provides digital accounting, e-invoicing, POS, and cloud automation software. Their solutions serve micro-SMEs, SMEs, and larger enterprises to improve operational efficiency and digital transformation capabilities.

Location

- Lot 12, Jalan Digital, Kuala Lumpur, Malaysia

Listed on Bursa Malaysia

- ACE Market, proposed transfer to Main Market pending completion

- IPO proceeds: RM50.00 million, Stock code: 0225

- Sector: Digital Technology & Software Distribution