Is GENERGY’s Post-IPO Dip a Buying Opportunity? A Deep Dive into Q3 FY2025 Financials

Date: December 13, 2025

Company: Wasco Greenergy Berhad (GENERGY)

Listing: Main Market, Bursa Malaysia

Two days ago, Wasco Greenergy Berhad (GENERGY) made its debut on the Main Market of Bursa Malaysia. If you’ve been watching the ticker, you know the market reaction has been mixed, with the stock facing pressure below its RM1.00 IPO price.

But as seasoned market players know, price is what you pay, value is what you get.

Whether you are a retail investor caught in the IPO hype, a trader looking for a bounce, or a fundamental investor scouting for long-term renewable energy plays, the answer lies in the numbers. We’ve dissected GENERGY’s latest Q3 FY2025 Financial Report (for the period ended Sept 30, 2025) to help you decide your next move.

-Financial-Review-Q3-2025-Rec.webp)

1. Introduction: Who is GENERGY?

Before we crunch the numbers, let’s understand the business. GENERGY is the renewable energy arm spun off from Wasco Berhad. They specialize in energy efficiency and renewable energy, specifically:

- EPCC (Engineering, Procurement, Construction, Commissioning): Building steam energy systems (Biomass, Gas-fired).

- Industrial Equipment: Manufacturing turbines and palm oil milling equipment.

- The Pivot: They are moving from just building plants to owning them (Asset Ownership model) to generate recurring income.

Why review the financials now? The “IPO Story” is about future promises. The “Financial Statements” are the reality check. With the stock freshly listed, this Q3 report is your first real look under the hood.

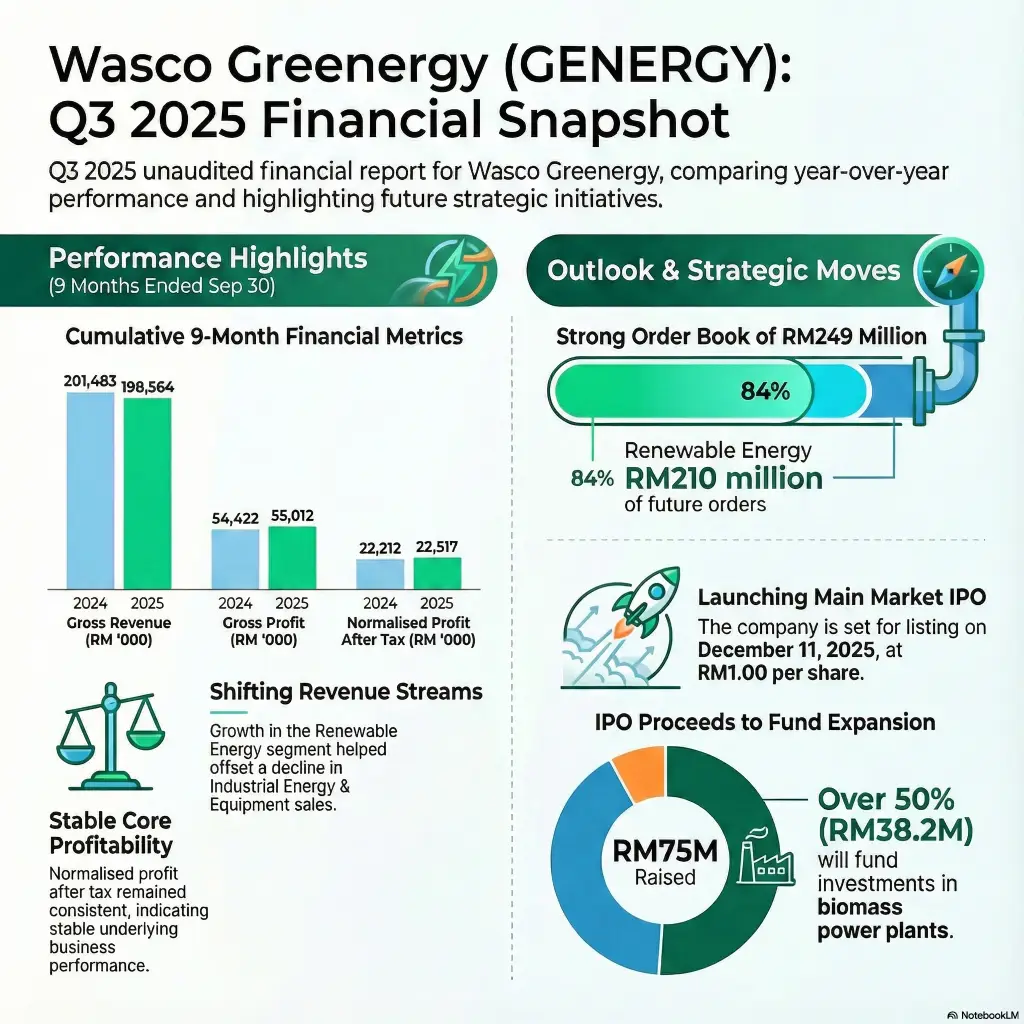

2. Revenue Analysis: Top-Line Stagnation?

For Beginners

Revenue is the total money coming in from sales. GENERGY’s sales have slightly cooled off.

- This Quarter (Q3): Sales dropped to RM72.4 million (down from RM81.5 million last year).

- Year-to-Date (9 Months): Revenue is effectively flat at RM198.6 million (slightly down from RM201.5 million).

For Advanced Investors

The devil is in the details. The revenue drop isn’t uniform across the company.

- Renewable Energy (The Core): This segment is growing cumulatively (RM174.3M vs RM169.8M), driven by steam energy projects. However, it stumbled in Q3 due to timing issues with steam turbine deliveries.

- Industrial Equipment (The Drag): This segment is shrinking (RM24.2M, down from RM31.7M) due to lower demand for palm oil mill equipment.

The Takeaway: The “growth engine” (Renewable Energy) is still running, but it sputtered slightly this quarter. The legacy equipment business is slowing down.

3. Profit Margins: Efficiency Saves the Day

Despite lower sales, GENERGY actually made more profit this quarter than the same time last year. How? Better Margins.

- Gross Profit: RM22.7 million.

- Net Profit (Q3): RM11.0 million (Up from RM9.4 million in Q3 2024).

- EPS (Earnings Per Share): 2.26 sen for the quarter.

Understanding “Normalised Profit” (Crucial for Fundamental Investors) If you look at the 9-month total, Net Profit seems to have crashed from RM30.6M to RM18.9M. Don’t panic.

- Last year’s number was inflated by a one-off asset sale gain (RM8.4M).

- This year’s number is dragged down by IPO listing expenses (RM3.6M).

- The Real Number: If you strip out these “noisy” items, the Normalised Profit is RM22.5 million, almost identical to last year (RM22.2 million).

Verdict: The underlying business is stable and profitable, even if the headline numbers look messy.

4. Dividend Review: What for Income Hunters?

- Current Status: As a freshly listed growth company, GENERGY has not declared a dividend for this quarter.

- The Strategy: The company is currently in an aggressive expansion phase. The RM75 million raised from the IPO is earmarked for buying assets and expanding into Indonesia.

- Investor Note: Do not buy this stock now expecting immediate quarterly checks. You are buying for capital appreciation (stock price going up). Dividends will likely come later once their recurring income streams (Asset Ownership) mature.

5. Balance Sheet: Solvency & IPO Impact

Is the company safe? Yes, and it just got safer.

- Total Assets: RM321.4 million.

- Total Equity: RM188.8 million.

- Gearing (Debt Level):

- The Debt-to-Equity ratio has improved to 0.70x (down from 0.80x).

- This means for every RM1 of shareholder money, they owe RM0.70. This is a healthy, manageable level for an engineering company.

The IPO Bonus Remember, the Q3 report (dated Sept 30) does not yet reflect the RM75 million raised from the IPO two days ago.

- Implication: When the Q4 report comes out, cash balances will spike, and net gearing will likely drop significantly. The company has plenty of “dry powder” to fund growth.

6. Cash Flow: The Red Flag?

This is the most concerning part of the report that investors must watch.

- Operating Cash Flow (OCF): Negative RM730,000.

- Last year, they generated positive cash of RM7.1 million.

- Why is it negative? Even though they made profit, they haven’t collected the cash yet. Receivables (money owed by clients) increased by RM17.1 million.

Is this bad? It’s common in the EPCC (construction/engineering) industry. You build first, bill later, and get paid last. With a growing Order Book (RM249 million), working capital gets “stuck” in projects. However, burn rate matters. They need to collect this cash to avoid taking on more debt.

7. Investment Implications: What Should You Do?

🛒 For Retail & Beginner Investors

- The Vibe: The stock is currently trading below IPO price (RM1.00). The market is nervous about the “disappointing debut.”

- Action: Don’t catch a falling knife blindly. Wait for the price to stabilize. The company is profitable, so it’s not a “junk” stock, but sentiment is weak right now.

⚡ For Traders & Short-Term Players

- The Play: Watch the RM0.88 - RM0.90 support levels. The “Normalised Profit” proves the business isn’t collapsing. An oversold bounce is possible if they announce a new contract win from that RM249M order book.

- Risk: The negative cash flow is a weak point bears will target.

🏗️ For Long-Term Fundamental Investors

- The Gem: You are paying for the Pivot. The transition to “Asset Ownership” (selling steam as a utility rather than just building boilers) deserves a higher valuation multiple if they execute it.

- Valuation: With a normalised annual profit run-rate of ~RM30M, the P/E ratio at current prices is becoming attractive. The cash injection from the IPO de-risks the balance sheet.

- Watch: The execution of the “Indonesia Expansion” plan mentioned in their prospectus.

💰 For Dividend Hunters

- Verdict: Look elsewhere for now. This is a growth story, not a yield story.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Please do your own research before making any investment decisions.

8. Key Takeaways

- ✅ Profitability is Intact: Core (normalised) Net Profit is stable at RM22.5M despite revenue headwinds.

- ✅ Strong Balance Sheet: Gearing is low (0.70x) and will improve further with IPO proceeds.

- ✅ Healthy Order Book: RM249 million in jobs guarantees revenue visibility for the next 12-18 months.

- ⚠️ Cash Flow Strain: Operating cash flow turned negative due to high receivables. Collections need to improve.

- ⚠️ Revenue Growth Stalled: Top-line growth is flat; the company needs the IPO funds to kickstart the new “Asset Ownership” revenue stream.

9. Company Information (At a Glance)

- Company Name: Wasco Greenergy Berhad

- Stock Code: GENERGY (5343)

- Sector: Energy / Renewable Energy

- Listing Date: December 11, 2025 (Main Market, Bursa Malaysia)

- IPO Price: RM1.00

- Headquarters: Shah Alam, Selangor, Malaysia.

- Principal Activities:

- EPCC of steam energy systems (Biomass, Gas-fired, HRSG).

- Manufacturing of steam turbines and palm oil milling equipment.

- Operation of renewable energy plants (Asset Ownership).